2024 Tax Brackets Aarp Medicare

2024 Tax Brackets Aarp Medicare – Your tax bill is largely determined by tax brackets. These are really just ranges of taxable income. As your taxable income moves up this ladder, each layer gets taxed at progressively higher rates. . A portion of your Social Security (SS) benefits may be subject to federal taxation according to rates set “IRS Provides Tax Inflation Adjustments for Tax Year 2024.” AARP. .

2024 Tax Brackets Aarp Medicare

Source : www.aarp.org

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

7 Changes in 2024 That Impact Retirement Finances

Source : www.aarp.org

Lisa Humes on LinkedIn: What Are the Tax Brackets for 2023 and 2024?

Source : www.linkedin.com

Social Security COLA Increase Set at 3.2% for 2024

Source : www.aarp.org

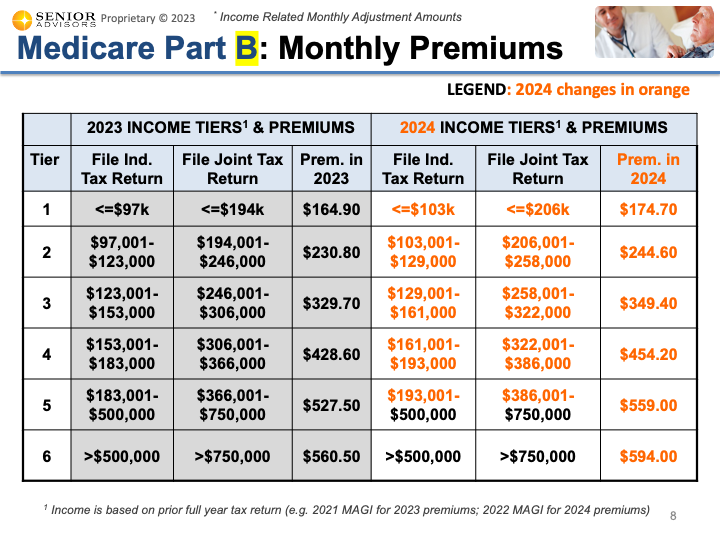

Medicare Blog: Moorestown, Cranford NJ

Source : www.senior-advisors.com

What Changes Are Coming to Medicare in 2024?

Source : www.aarp.org

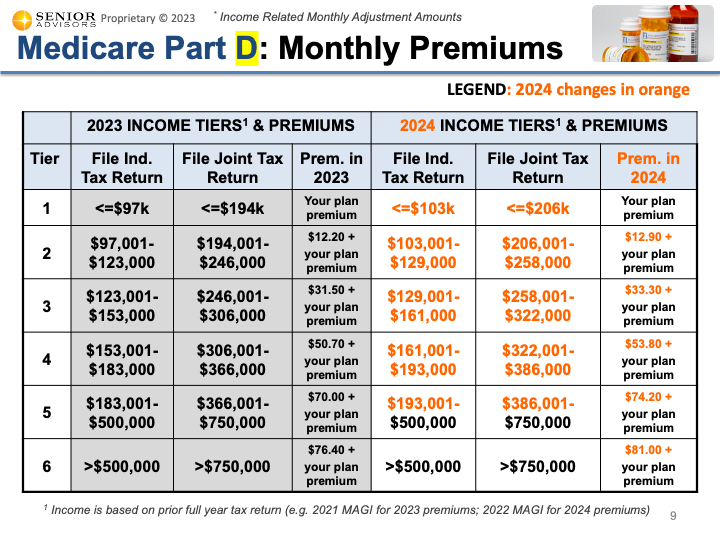

Medicare Blog: Moorestown, Cranford NJ

Source : www.senior-advisors.com

2024 Tax Brackets Aarp Medicare IRS Sets 2024 Tax Brackets with Inflation Adjustments: Medicare tax is taken out of your paycheck to pay for Medicare Part A, which provides hospital insurance to seniors and people with disabilities. The total Medicare tax amount is split between . As a result, anyone in a marginal income tax bracket below 22% would likely see and payroll taxes for Social Security and Medicare. Taxpayers may get overpaid taxes back as a refund during .