2024 W 4 Form State Tax

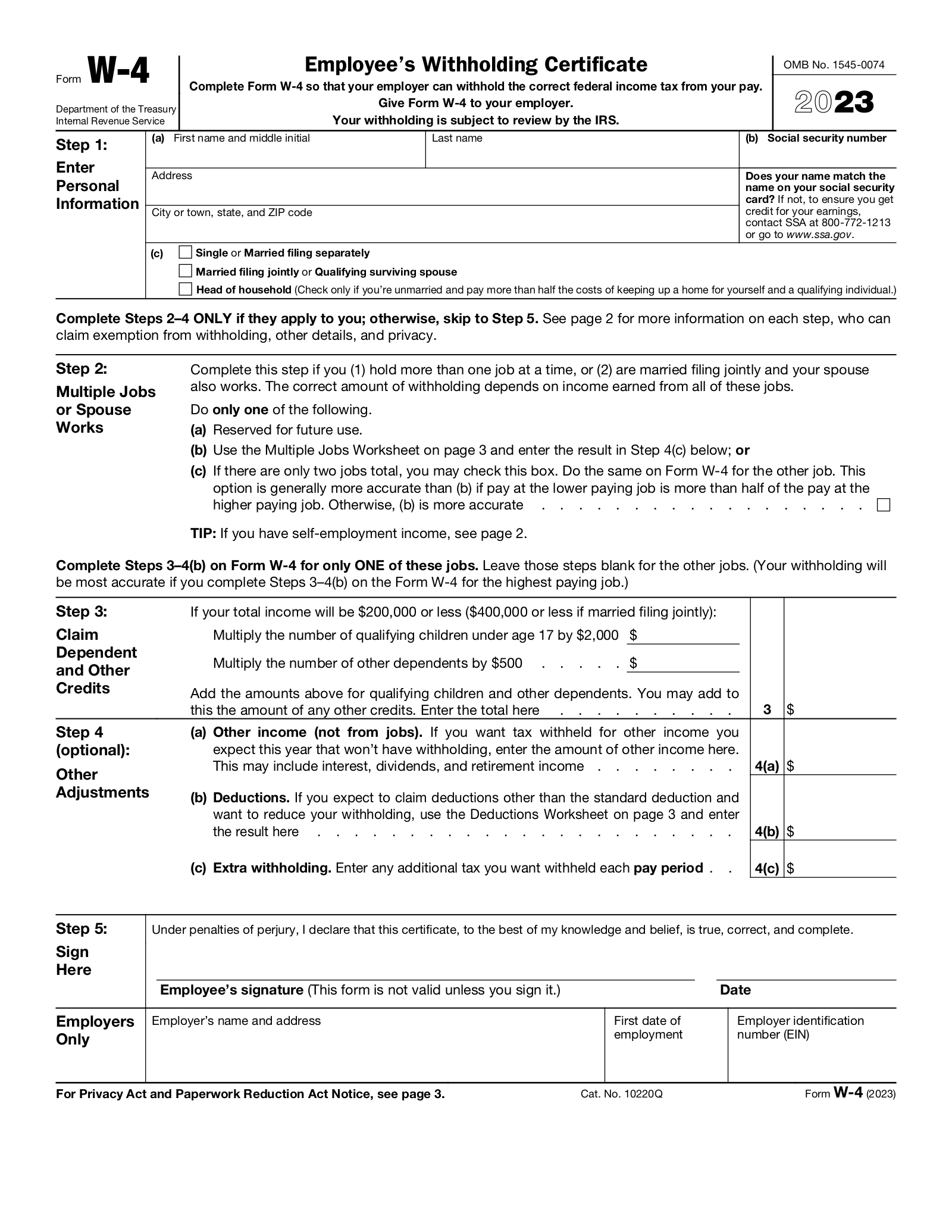

2024 W 4 Form State Tax – A Form W-4 is a tax document that employees fill out when certain payroll taxes and remit the taxes to the IRS and state and local authorities (if applicable) on behalf of employees. . There are a lot of different tax forms the IRS requires you or your employer to fill out. Some of the most common ones are the W-2, W-4, 1099 and W-9. .

2024 W 4 Form State Tax

Source : www.nerdwallet.com

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

Employee’s Withholding Certificate

Source : www.irs.gov

How to Fill Out a W 4: 2024 W 4 Guide | Gusto

Source : gusto.com

2024 Form W 4P

Source : www.irs.gov

How to Fill Out a W 4: 2024 W 4 Guide | Gusto

Source : gusto.com

How to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.com

Free IRS Form W4 (2024) PDF – eForms

Source : eforms.com

How to Fill Out a W 4: 2024 W 4 Guide | Gusto

Source : gusto.com

Instructions & Tips to Help You Fill Out & Submit a W 4 Form

Source : www.efile.com

2024 W 4 Form State Tax W 4: Guide to the 2024 Tax Withholding Form NerdWallet: You can review your current W-4 information on BannerWeb>Employee Services Online>Tax Forms>W4 Tax Exemptions or Allowances. To change your W-4 form, BannerWeb>Employee Services Online>Tax . But you likely filled out a W-4 form state from their employer, those are all important things to review and look at the withholdings,” Williams says. If you regularly receive a large tax .