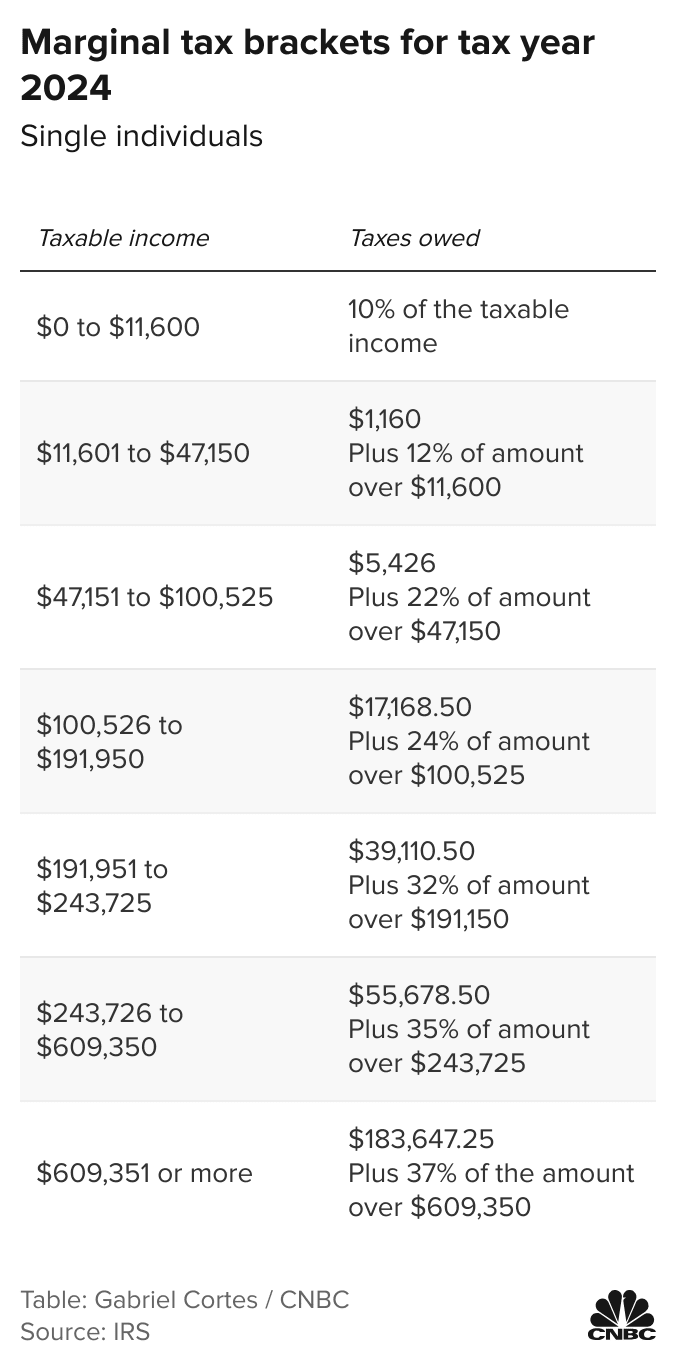

Tax Brackets 2024 Single Filers

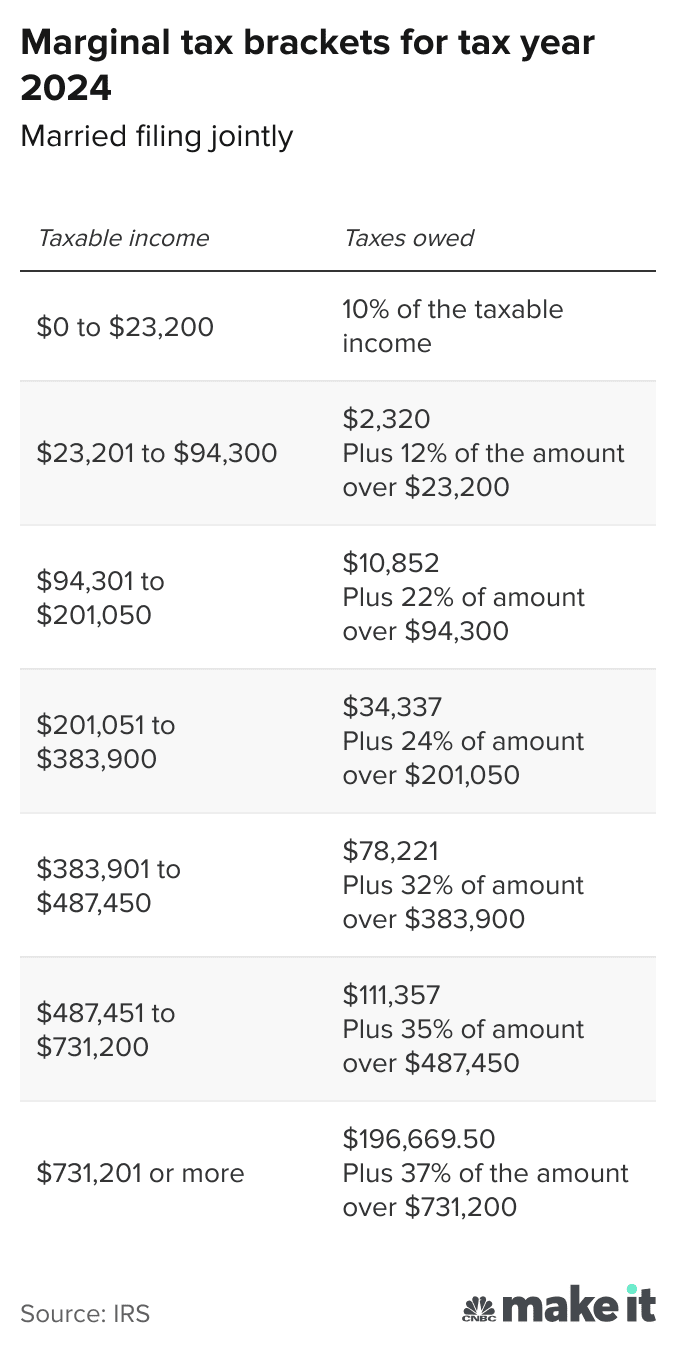

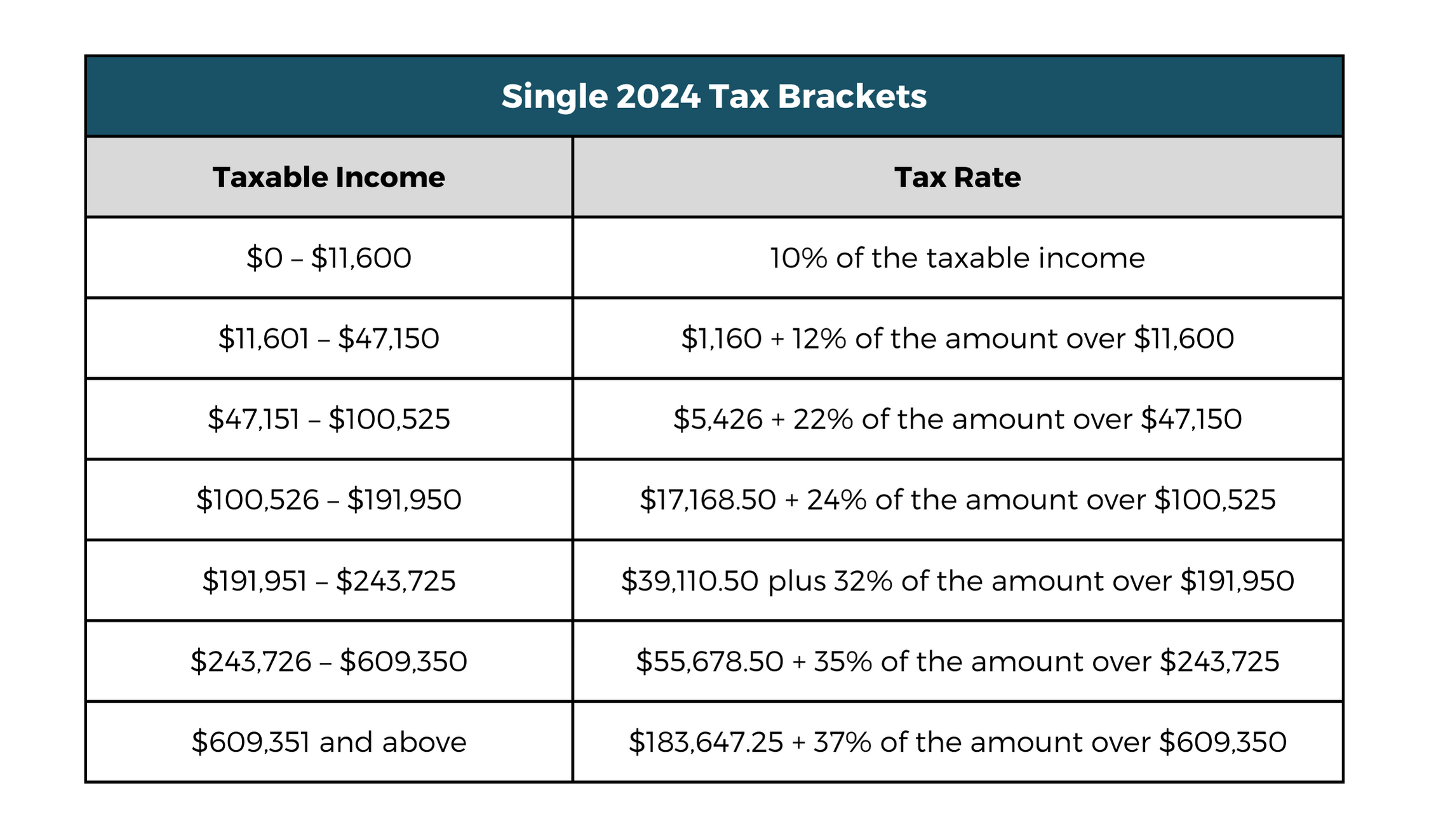

Tax Brackets 2024 Single Filers – There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. . The IRS reviews all income tax brackets annually, making adjustments as necessary to balance for inflation. For the 2024 tax year, tax rates range from 10% at the low end to a top rate of 37%. These .

Tax Brackets 2024 Single Filers

Source : www.forbes.com

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

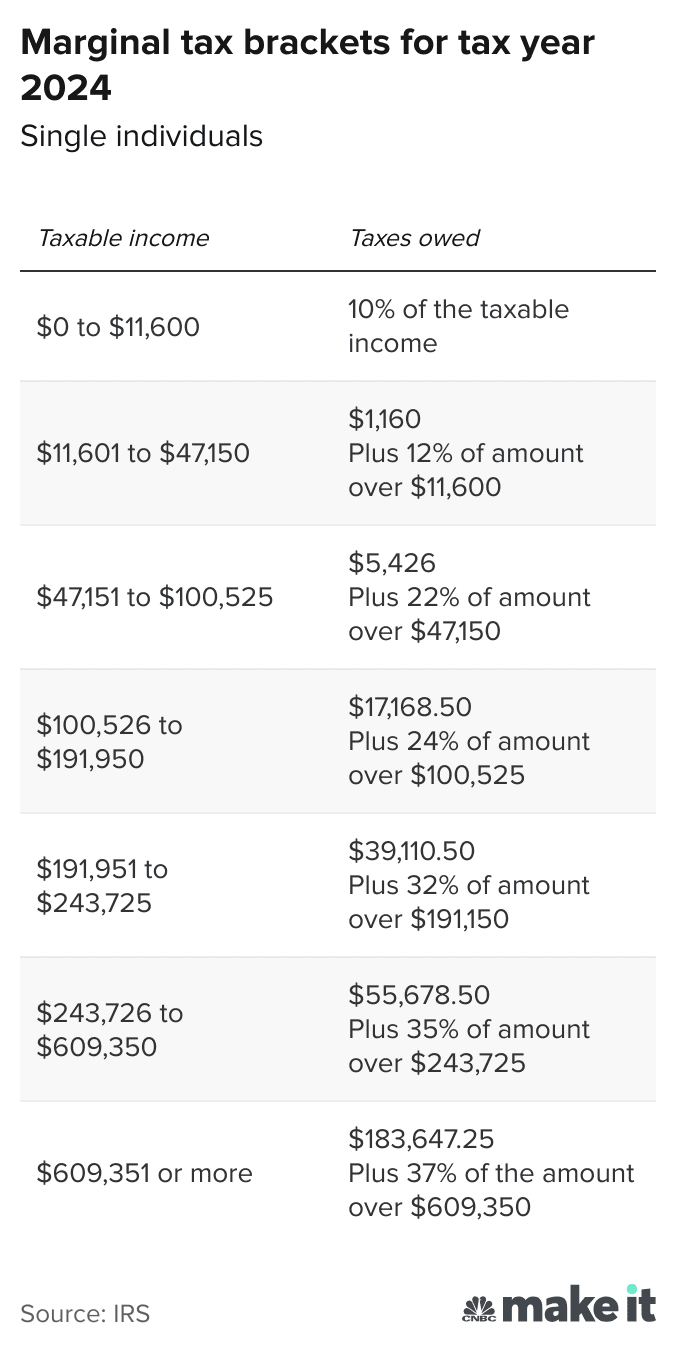

2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.com

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

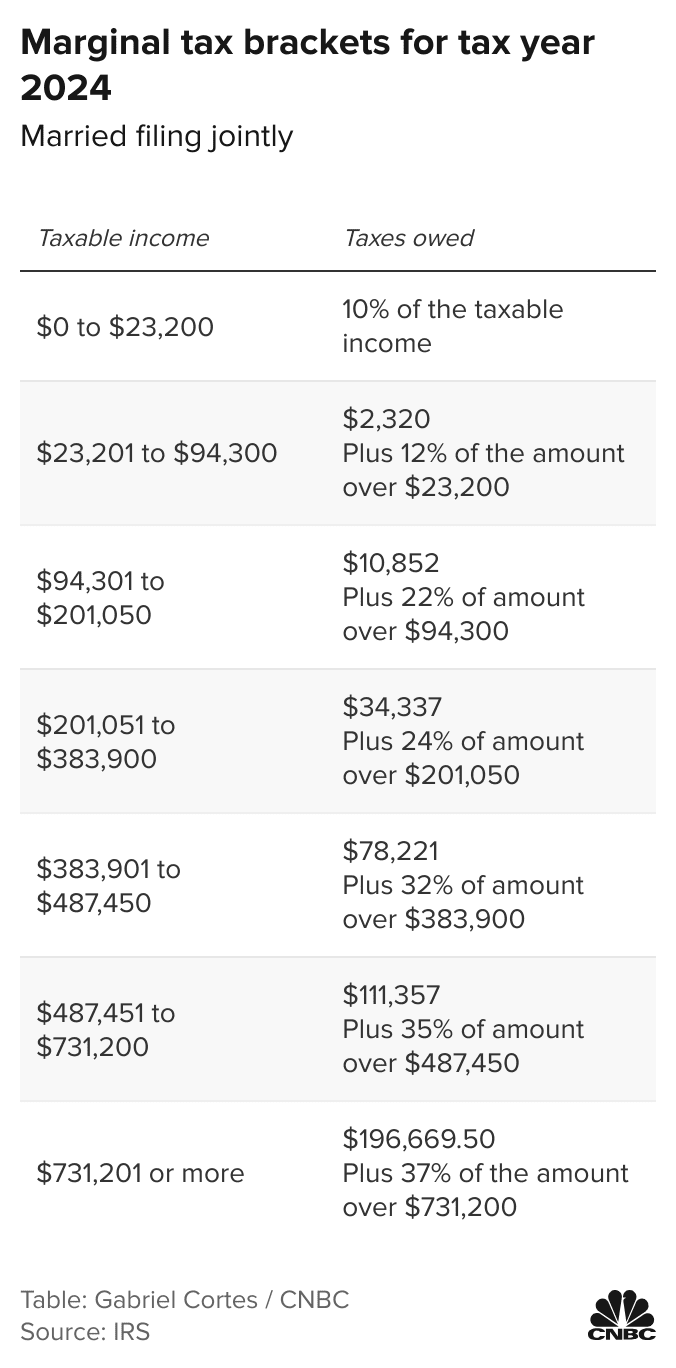

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

2024 Tax Code Changes: Everything You Need To Know | RGWM Insights

Source : rgwealth.com

2024 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Source : taxfoundation.org

Tax Brackets 2024 Single Filers Your First Look At 2024 Tax Rates: Projected Brackets, Standard : Here’s an example of how it works: Suppose you’re earning $45,000 and you’re a single tax filer. Your marginal tax rate — meaning don’t sweat it if your income is likely to be taxed in a higher . With the new year comes new beginnings … such as the start of a new tax year. And with a new tax year comes new opportunities to plan ahead for the income and expenses that will be reported on your .